🎁 Want a Surprise?

Click here to get redirected to a random post

Introduction

The real estate market has long been associated with large capital investments and complex ownership structures, making it difficult for many individuals to enter the market. However, the rise of fractional real estate ownership is changing this narrative. This innovative finance-driven trend enables multiple investors to own a portion of a property, lowering entry barriers and unlocking new investment opportunities.

This article explores the concept of fractional real estate ownership, how it works, its financial advantages, challenges, and its growing influence in the property market.

What is Fractional Real Estate Ownership?

Fractional ownership means dividing the rights to a property among several individuals or entities, each holding a defined percentage or “fraction” of the asset. Unlike traditional sole ownership, this model allows investors to pool resources to purchase and manage real estate collectively.

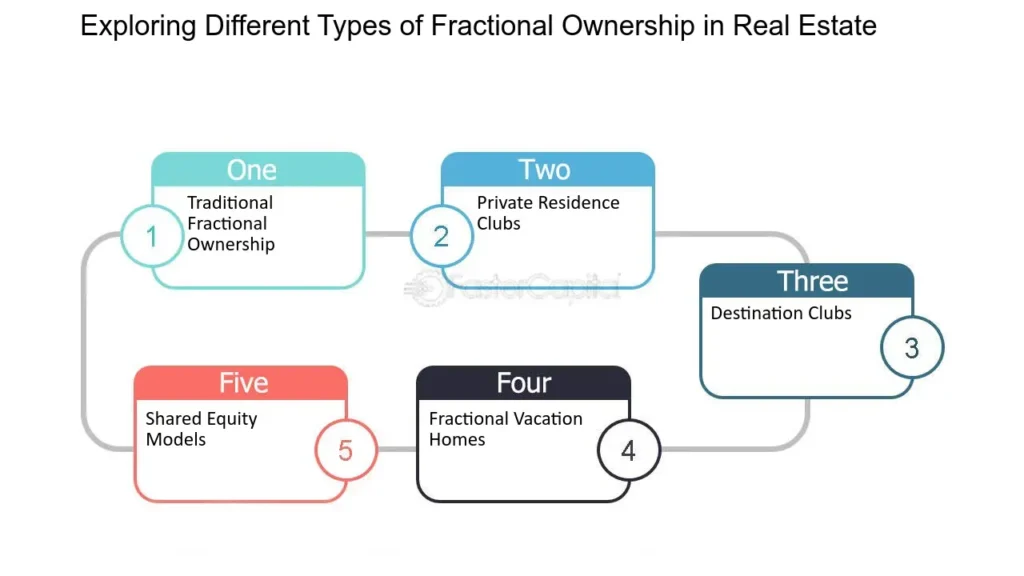

Types of Fractional Ownership

- Equity Fractional Ownership: Investors hold an actual equity stake proportional to their investment and share in income, appreciation, and decision-making.

- Right-to-Use Fractional Ownership: Common in vacation properties, investors buy a right to use the property for a specific period each year but do not hold equity.

- Real Estate Investment Trusts (REITs) and Tokenized Real Estate: While slightly different structures, they provide similar fractional exposure to real estate through pooled investment vehicles.

How Does Fractional Ownership Work?

Fractional ownership can be structured in various ways, but typically involves:

- Legal Agreement: Investors enter into contracts detailing ownership shares, rights, responsibilities, and governance mechanisms.

- Management Entity: A third party often manages property maintenance, rentals, and finances on behalf of the owners.

- Financial Contributions: Each investor contributes capital based on their ownership percentage and shares costs such as maintenance, taxes, and repairs.

- Income and Appreciation Sharing: Rental income and profits from eventual sale are distributed according to ownership stakes.

Financial Advantages of Fractional Real Estate Ownership

1. Lower Capital Requirement

Fractional ownership allows investors to participate in high-value properties with significantly smaller capital outlays, democratizing access to real estate.

2. Diversification

Investors can spread risk across multiple properties or markets by purchasing fractional shares in various assets, reducing exposure to any single investment.

3. Potential for Passive Income

Properties with rental income generate cash flow distributed among owners, providing a potential source of passive income without the hassles of sole property management.

4. Shared Expenses and Risk

Costs for maintenance, property taxes, and unforeseen repairs are shared among investors, reducing individual financial burdens.

5. Liquidity Options

With the rise of blockchain and digital platforms, fractional shares can sometimes be traded more easily than traditional real estate, offering improved liquidity.

The Growing Popularity of Fractional Real Estate Ownership

Accessibility Through Technology

Online platforms and blockchain-based marketplaces enable seamless buying, selling, and management of fractional real estate shares, making the process more user-friendly and transparent.

Appeal to Millennials and Younger Investors

Younger generations, often priced out of traditional property markets, find fractional ownership an attractive way to build wealth and diversify portfolios.

Interest from Institutional Investors

Institutions and funds are increasingly incorporating fractional ownership models to tap into retail investor demand and improve liquidity.

Challenges and Considerations

Governance and Decision-Making

Managing a property with multiple owners requires clear governance structures to handle decisions about maintenance, leasing, or sale. Conflicts can arise if not properly addressed.

Legal and Regulatory Complexities

Fractional ownership arrangements must comply with local real estate laws and securities regulations, which can be complex and vary by jurisdiction.

Limited Control

Individual investors usually have limited control over daily management, which is handled by designated managers or platforms.

Market and Liquidity Risks

While fractional shares can offer liquidity, market demand may fluctuate, and selling shares may not always be straightforward.

Use Cases and Real-World Examples

Vacation Homes

Fractional ownership is common for vacation properties, allowing multiple owners to enjoy the property at different times and share upkeep costs.

Commercial Real Estate

Investors use fractional ownership to access commercial properties such as office buildings, retail centers, or industrial warehouses, diversifying beyond residential real estate.

Luxury Real Estate

High-net-worth individuals use fractional ownership to share costs and access luxury assets that might be prohibitively expensive to own individually.

How to Invest in Fractional Real Estate

- Research Platforms: Look for reputable online platforms offering fractional real estate investments.

- Understand Terms: Carefully review ownership agreements, fees, and exit options.

- Assess Property Quality: Evaluate location, property condition, and income potential.

- Check Regulatory Compliance: Ensure the offering complies with relevant securities and property laws.

- Consider Your Investment Goals: Determine if fractional ownership fits your risk tolerance and financial objectives.

The Future of Fractional Real Estate Ownership

Advancements in blockchain technology, smart contracts, and online marketplaces are expected to accelerate the growth of fractional ownership. These technologies improve transparency, reduce costs, and increase liquidity, making real estate investments more accessible to a wider audience.

Fractional ownership is poised to become a mainstream investment model, transforming how people access and benefit from real estate.

Conclusion

Fractional real estate ownership represents a finance-driven innovation that breaks down traditional barriers to property investment. By enabling shared ownership, reducing capital requirements, and offering diversification opportunities, it opens the door for many new investors to participate in the real estate market.

While challenges such as governance and regulatory compliance exist, technological advances and growing market acceptance are addressing these issues, making fractional ownership an increasingly attractive option for both individual and institutional investors.

Frequently Asked Questions (FAQs)

Q1: How is fractional ownership different from timeshares?

Fractional ownership involves equity stakes and shared profits, while timeshares only grant usage rights without ownership.

Q2: Can fractional ownership properties be rented out?

Yes, rental income is often generated and distributed among owners according to their shares.

Q3: Is fractional real estate ownership risky?

Like all investments, it carries risks including market fluctuations, property depreciation, and management challenges.

Q4: How can I sell my fractional ownership share?

Selling depends on the platform or agreement; blockchain-based shares can sometimes be traded on secondary markets.

Q5: Are there tax implications with fractional ownership?

Yes, investors may be liable for property taxes and income taxes on rental income or capital gains.