🎁 Want a Surprise?

Click here to get redirected to a random post

Introduction

Real estate syndications have emerged as a powerful vehicle for investors seeking to participate in larger, often institutional-quality property investments without the hassles of direct ownership. By pooling capital from multiple investors, syndications open doors to lucrative real estate opportunities otherwise inaccessible to individuals.

This article offers a comprehensive look at real estate syndications from a financial perspective—how they work, benefits, risks, and why they are increasingly popular in the investment landscape.

What Are Real Estate Syndications?

A real estate syndication is a partnership where a group of investors pools their resources to acquire, manage, and profit from a property or portfolio of properties. Typically, the syndication is structured with two key roles:

- General Partner (GP) or Sponsor: Manages the investment, makes decisions, handles operations, and assumes liability.

- Limited Partners (LPs): Passive investors who provide capital but have limited involvement in day-to-day management.

How Does a Real Estate Syndication Work?

Capital Pooling

Multiple investors contribute funds to collectively purchase a property, enabling acquisition of larger or higher-quality real estate assets than they could individually afford.

Investment Structure

- The GP identifies, acquires, and manages the property.

- LPs provide equity capital in exchange for ownership shares proportional to their investment.

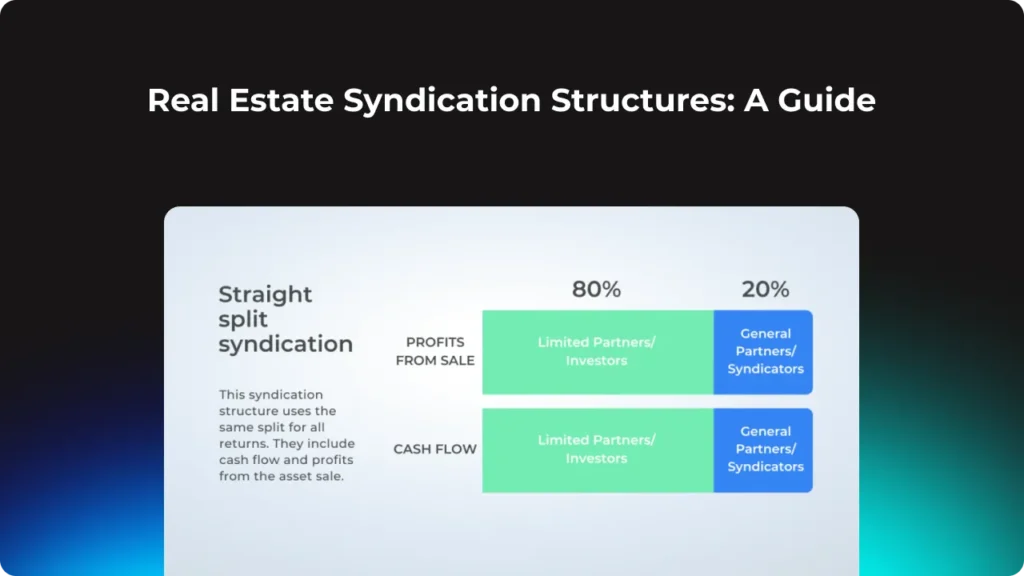

- Profits—rental income, tax benefits, and capital gains—are distributed according to an agreed-upon structure.

Financial Agreements

The operating agreement outlines key financial terms, including:

- Preferred Return: A minimum annual return paid to LPs before the GP receives profits.

- Profit Split (Carried Interest): How remaining profits are shared between LPs and GP after preferred returns.

- Capital Calls: Potential future funding requests beyond initial investments.

Financial Advantages of Real Estate Syndications

1. Access to Larger, Institutional-Grade Assets

Syndications allow individual investors to participate in high-value commercial properties such as office buildings, apartment complexes, or industrial facilities.

2. Passive Investment Opportunity

Investors enjoy exposure to real estate without active management responsibilities.

3. Diversification

Pooling capital across multiple investors enables investment in diversified properties, reducing risk.

4. Economies of Scale

Larger properties often generate more stable cash flows and better returns due to operational efficiencies.

5. Tax Benefits

Syndications often pass through tax advantages like depreciation and interest deductions to investors.

Key Financial Metrics to Evaluate in Syndications

Cash-on-Cash Return

Measures the annual cash income relative to the cash invested, indicating immediate cash flow.

Internal Rate of Return (IRR)

A comprehensive metric that accounts for all cash flows over the investment horizon, including sale proceeds.

Equity Multiple

Total cash distributions divided by the initial equity invested, showing total return on capital.

Preferred Return

The minimum return promised to investors before profit sharing.

Risks and Considerations

Illiquidity

Real estate syndications typically have long lock-up periods (5-10 years), limiting the ability to sell shares quickly.

Sponsor Risk

The GP’s experience and decision-making critically impact the investment outcome.

Market and Property Risk

Economic downturns, vacancies, or unexpected expenses can affect cash flow and appreciation.

Regulatory and Legal Complexity

Syndications are subject to securities laws and require compliance, making due diligence essential.

Who Should Consider Real Estate Syndications?

- Accredited Investors: Many syndications require investors to meet income or net worth thresholds.

- Passive Investors: Those seeking exposure to real estate without managing properties.

- Diversification Seekers: Investors looking to add commercial real estate to their portfolio.

- Long-Term Investors: Those comfortable with multi-year commitments and illiquidity.

How to Evaluate a Real Estate Syndication Opportunity

- Review the Sponsor’s Track Record: Experience and past performance matter.

- Understand Financial Projections: Scrutinize expected returns, cash flow, and exit strategies.

- Analyze Market Fundamentals: Location, economic conditions, and property type influence success.

- Examine Fees and Profit Splits: Understand how fees impact net returns.

- Read Legal Documents Carefully: Review the private placement memorandum (PPM) and operating agreement.

The Future of Real Estate Syndications

Technology platforms and crowdfunding models are making syndications more accessible, transparent, and easier to manage. Increased regulatory clarity and investor education continue to fuel growth in this space.

Conclusion

Real estate syndications represent an exciting financial opportunity that democratizes access to large-scale property investments. By pooling capital, sharing risks, and leveraging professional management, syndications enable investors to participate in real estate wealth creation with less hands-on effort.

Understanding the financial dynamics—from returns and risks to legal structures—ensures investors can make informed decisions that align with their goals. As the market evolves, real estate syndications are poised to play an increasingly important role in diversified investment strategies.

Frequently Asked Questions (FAQs)

Q1: What is the minimum investment amount in a syndication?

It varies but typically ranges from $25,000 to $100,000.

Q2: Can I sell my syndication interest before the project ends?

Most syndications have limited liquidity; secondary market sales are rare and often restricted.

Q3: Are real estate syndications safe?

Like all investments, they carry risks. Due diligence on sponsors and market conditions is essential.

Q4: How are profits distributed?

Typically, LPs receive preferred returns first, then profits are split between LPs and the GP.

Q5: Do I have a say in property management?

Limited partners usually have no active management role.